Editor:

Ringel • Schramm

Partnership mbB

Dr. Volker Schramm

Kardinal-Faulhaber-Strasse 15

D-80333 Muenchen

Germany

or send an email to:

schramm@ringel-schramm.de

Person responsible under Section 55 RStV (German Inter-State Agreement on Broadcasting):

Dr. Volker Schramm

Ringel • Schramm

Partnership mbB

Dr. Volker Schramm

Kardinal-Faulhaber-Strasse 15

80333 Muenchen (Munich)

Germany

Concept and realization:

bureau tim walter

Tim Walter

Hübnerstraße 3

80637 München

Germany

Website: timwalter.de

E-mail: tim.walter@timwalter.de

Telephone no.: +49 (89) 12507984

Obligatory information:

Ringel • Schramm Partnership of Lawyers, Tax Advisers

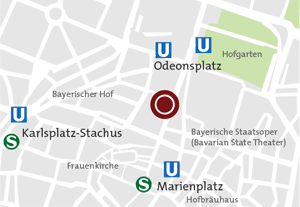

Kardinal-Faulhaber-Strasse 15, 80333 Muenchen (Munich), Germany

Telephone no.: +49 (89) 288 111 50

Fax: +49 (89) 288 111 99

E-mail: info@ringel-schramm.de

Website: www.ringel-schramm.de

Information on the legal form, registered office and representation

Ringel • Schramm Partnership of Lawyers, Tax Advisers is a partnership registered with the Munich Partnership Registry, PR 1035. Its registered office is in Munich.

The partners of Ringel • Schramm Partnership of Lawyers, Tax Advisers are: Dr. Martin Ringel, Lawyer; Dr. Volker Schramm, Lawyer; Dr. Rainer Deininger, Lawyer; Jochen Moessmer, Tax Adviser, and Hans Leitl, Tax Adviser.

All partners are individually authorized to represent the partnership.

Tax identification number: 143/560/20384

VAT identification number: DE 276816546

Insurance

Professional liability insurance cover (pecuniary loss liability insurance) for the partnership and all lawyers and tax advisers working in it is provided by AXA Versicherung AG, Niederlassung Koeln, Wiener Platz 3, 51065 Koeln (Cologne)

Professional Authorization

Dr. Martin Ringel, Dr. Volker Schramm and Dr. Rainer Deininger are authorized in the Federal Republic of Germany to practice the profession of lawyer and are members of the Professional Chamber of Lawyers for the Higher Regional Court district Munich, whose address is: Oberlandesgerichtsbezirk Muenchen,Tal 33, 80331 Muenchen, Germany

Jochen Moessmer and Hans Leitl are authorized in the Federal Republic of Germany to practice the profession of tax adviser and are members of the Professional Chamber of Tax Advisers Munich, whose address is: Steuerberaterkammer Muenchen, Nederlinger Straße 9, 80638 Muenchen, Germany

The following regulations are in effect for the profession:

The following regulations governing the profession are to be respected by our lawyers:

- BRAO Bundesrechtsanwaltsordnung (Federal Lawyers' Act)

- BORA Berufsordnung für Rechtsanwälte (Professional Regulation for Lawyers)

- Fachanwaltsordnung (Certified Specialist Lawyers' Regulation)

- RVG Rechtsanwaltsvergütungsgesetz (Act concerning the Remuneration of Lawyers)

- BRAGO Bundesgebührenordnung für Rechtsanwälte (Federal Regulation on Lawyers' Fees)

- Berufsregeln der Rechtsanwälte der Europäischen Gemeinschaft (CCBE) (Code of Conduct for Lawyers in the European Union)

- Gesetz über die Tätigkeit europäischer Rechtsanwälte in Deutschland (EuRAG) of March 9, 2000 (Act concerning the Professional Activities of European Lawyers in Germany)

All texts are available online at www.brak.de/fuer-anwaelte/berufsrecht/.

The following regulations governing the profession are to be respected by our tax advisers:

StBerG - Steuerberatungsgesetz (Act concerning Tax Advice Services)

- Durchführungsverordnung des Steuerbartungsgesetzes (DVStB) (Implementing Regulation on the Act concerning Tax Advice Services)

- StBGebV - Steuerberatergebührenverordnung (Regulation on Tax Advisers' Fees)

- StBVV - Steuerberatervergütungsverordnung (since December 20, 2012) (Regulation on the Remuneration of Tax Advisers)

- BOStB - Berufsordnung der Bundessteuerberaterkammer und Fachberaterordnung (Occupational Regulations of the Federal Chamber of Tax Advisers and the Regulation for Specialist Tax Advisers)

All texts are available online at www.bstbk.de/de/steuerberater/berufsrecht/.

Declaration on data protection

1. Object of the declaration on data protection

Please find below detailed information on the data collected during your visit on our website and your use of the services on our website and on how we process and/or use such data thereafter.

2. As a general rule, you are not required to provide personal data for using our website.

Instead, during your visit on our website, we only collect and use data which is automatically transmitted by your internet browser, such as:

• Date and time of retrieval of any of our web pages

• Your browser type

• The browser settings

• The operating system in use

• The page last visited by you

• The volume of data transmitted and the access status (file transmitted, file not found etc.) as well as

• Your IP address.

When you visit our website, we will collect and use such data only in a non-personalized form. This procedure makes the use of the internet pages you visit possible, serves statistical purposes and allows us to improve our online services. We save your IP address only for the time of your visit; it will not be evaluated in a personalized form.

Disclaimer:

Ringel • Schramm Partnership of Lawyers has made all reasonable efforts to guarantee that the information and links contained in this website are correct and complete.We accept no responsibility that the information provided on this website is up to date, correct, and complete. Any liability whatsoever in connection with the use of such information, the links and/or trust in their correctness shall be excluded. The information contained in this website does not constitute legal advice.

The content of this website is protected under copyright law. The copy and/or distribution of texts provided here is subject to the prior written approval by Ringel • Schramm Partnership of Lawyers.

Please consider that if you want to contact us via email, confidentiality will not be guaranteed due to the technical conditions on the internet. E-mails may also be changed by third parties or get lost.